The Ultimate Guide To Independent Investment Advisor Canada

Wiki Article

Investment Consultant Can Be Fun For Everyone

Table of ContentsWhat Does Tax Planning Canada Do?Getting The Independent Investment Advisor Canada To WorkThe Greatest Guide To Lighthouse Wealth ManagementWhat Does Investment Representative Mean?The Definitive Guide to Investment RepresentativeThe Main Principles Of Lighthouse Wealth Management

“If you were to purchase something, say a tv or a pc, you would want to know the specifications of itwhat tend to be their components and exactly what it may do,” Purda details. “You can contemplate getting economic advice and support in the same manner. People need to find out what they are buying.” With financial guidance, it is crucial that you keep in mind that the item isn’t ties, shares or any other assets.it is things like budgeting, planning for retirement or reducing personal debt. And like buying some type of computer from a trusted business, customers want to know they are purchasing economic guidance from a trusted specialist. Certainly Purda and Ashworth’s most fascinating conclusions is approximately the costs that monetary coordinators cost their clients.

This presented true irrespective of the charge structurehourly, fee, possessions under management or flat rate (inside the learn, the dollar property value fees had been exactly the same in each case). “It still comes down to the worthiness proposition and uncertainty regarding the people’ part they don’t determine what they're getting into trade for those fees,” states Purda.

Ia Wealth Management Fundamentals Explained

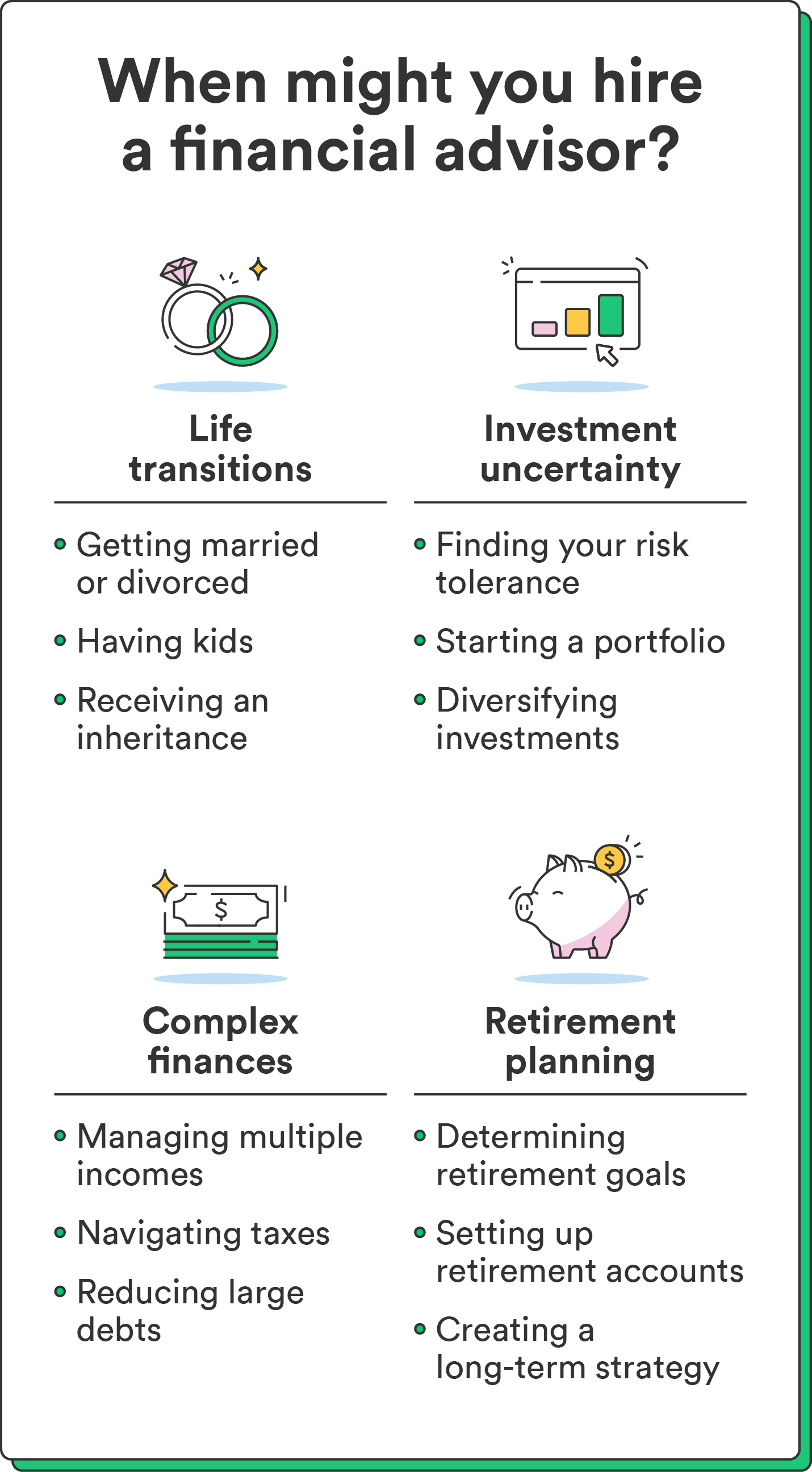

Listen to this short article When you listen to the word monetary advisor, what one thinks of? Many people remember a specialized who can give them financial guidance, particularly when considering investing. That’s a great place to start, however it doesn’t decorate the photo. Not close! Monetary advisors enables individuals with a lot of additional money objectives also.

An economic advisor makes it possible to develop wealth and shield it when it comes to longterm. They can calculate your personal future monetary requirements and program techniques to stretch the retirement savings. They could in addition help you on when to begin making use of Social protection and making use of the amount of money in your retirement records so you're able to avoid any horrible charges.

Get This Report on Financial Advisor Victoria Bc

They're able to support determine what shared resources are right for you and show you tips manage and come up with by far the most of your own financial investments. They can additionally support understand the threats and just what you’ll should do to get your aims. A seasoned financial investment professional can also help you stick to the roller coaster of investingeven when your assets take a dive.

They may be able give you the direction you ought to produce a plan so you can ensure that your wishes are carried out. And also you can’t put an amount tag throughout the satisfaction that accompanies that. In accordance with research conducted recently, the average 65-year-old few in 2022 needs to have around $315,000 stored to pay for medical care expenses in retirement.

Private Wealth Management Canada Fundamentals Explained

Given that we’ve reviewed just what financial advisors would, let’s dig inside kinds of. Here’s a beneficial guideline: All financial planners tend to be monetary advisors, although not all analysts are planners - http://tupalo.com/en/users/6114064. A monetary coordinator focuses primarily on helping folks generate plans to reach long-term goalsthings like starting a college account or keeping for a down repayment on a home

So how do you know which monetary advisor is right for you - https://www.bitchute.com/channel/rhnBTeLFYHxu/? Here are some things to do to be sure you are really employing just the right person. What do you do once you have two bad options to choose from? Easy! Get A Hold Of a lot more possibilities. The more solutions you really have, the much more likely you might be in order to make an excellent decision

7 Easy Facts About Investment Consultant Shown

All of our Smart, Vestor plan causes it to be easy for you by revealing you as much as five economic experts who is able to last. The good thing is actually, it is totally free to obtain related to an advisor! And don’t forget to come quickly to the meeting prepared with a list of questions to inquire of so you're able to figure out if they’re a great fit.But tune in, just because a specialist is smarter compared to average keep doesn’t provide them with the right to let you know how to handle it. Sometimes, advisors are full of by themselves since they have more degrees than a thermometer. If an advisor starts talking-down to you, it is time to demonstrate to them the door.

Keep in mind that! It’s essential that you and your monetary specialist (the person who it eventually ends up being) take alike web page. You prefer an expert who has a lasting investing strategysomeone who’ll encourage one to keep investing regularly whether the marketplace is up or down. independent investment advisor canada. You also don’t need to assist an individual who pushes one invest in something which’s also risky or you are unpleasant with

Examine This Report on Tax Planning Canada

That mix will provide you with the diversity you'll want to effectively invest when it comes to longterm. When you research financial analysts, you’ll most likely stumble on the expression fiduciary duty. All this suggests is actually any consultant you employ must work in a fashion that benefits their customer and never their self-interest.Report this wiki page